My Record

All records of your insurance contributions are kept and managed by the PRSI Records section in the Irish Department of Social Protection. The Department is responsible for the payments made as a result of your social insurance contributions.

The quickest and easiest way to apply for State pension is through MyWelfare. All you need is a verified MyGovID account. You can get verified MyGovID account if you have a Public Service Card, a verified mobile phone number and an email address.

If you have difficulty using this online facility, you can contact the PRSI Records customer service team for assistance

PRSI Records, Department of Social Protection

McCarter’s Road

Ardaravan

Buncrana

Donegal

Ireland

Your Contribution Statement is a summary of your social insurance (PRSI) record contributions in Ireland. When calculating your rate of State Pension (Contributory), the department uses your Contribution Statement to identify:

- your working history

- any time you spent on payments from the Department of Social Protection

- any time you spent caring

To calculate your State Pension (Contributory), the department will consider any contributions that are on your record up to your chosen pension drawdown date.

Your Contribution Statement is divided into different columns. Each column is explained below:

State Contributory Pension

How to qualify for a State Pension (Contributory) from 2025

- 1. You must have started making PRSI contributions at least 10 years before you draw down your pension

- 2. You must have a certain number of full-rate PRSI contributions. if you reach pension age on or after 6 April 2012, you need to have 520 full-rate PRSI contributions (10 years’ contributions), or, if at least 260 full-rate employment contributions are paid, the balance of the 520 can be made up with high-rate voluntary contributions.

- 3.You must have enough PRSI contributions. Once you meet the qualification criteria (see 1 and 2 above), the rate of payment you get depends on the number of social insurance (PRSI) contributions you have made. You may not get a State Pension (Contributory), if you don’t have enough PRSI contributions

In addition, you will be able to drawdown your State Pension (Contributory) at any age between age 66 and 70. Your pension drawdown date will be the date from which you want to start receiving State Pension (Contributory).

Mixed insurance pro-rata State Pension (Contributory)

Pro-rata pensions were introduced because some people were excluded from the social insurance system at particular times.

You may get a pro-rata pension if you have a mixed insurance record. This can happen when you spend:

- Part of your working life in the public service (where you pay modified-rate social insurance contributions) and

- Part of your working life in the private sector (where you pay full-rate social insurance contributions).

- If you reach pension age on or after 6 April 2012 and you have a mixed insurance record, you can get a pro-rata pension if you meet the following conditions:

- You have a minimum of 520 PRSI contributions (full-rate and modified-rate)

- You have at least 260 full-rate paid contributions since your entry into insurance

- Adding together a mixture of full-rate contributions and modified-rate contributions, gives you a yearly average of at least 10 from the time you first entered insurance. This yearly average condition does not apply if the TCA (or Aggregated Contributions Method) is used

- You do not qualify for a pension under EU regulations or under reciprocal arrangements with other countries (or you only qualify for a pension at a lower rate than this pro-rata pension would give you).

- If you meet all these conditions, you may qualify for a pension proportionate to the number of contributions you paid at the full rate. For example, if you worked for 40 years and 10 of those years were in the private sector, you would get one-quarter of the full pension.

Working Abroad

Ireland has social security arrangements with other countries that allow you to combine social insurance contributions that you have paid in Ireland with social insurance contributions that you have paid in another country. This can help you to qualify for a social security payment in Ireland or in a country with whom Ireland has a social security arrangement.

The social security arrangements that Ireland has with other countries can be divided broadly into 3 groups:

1.UK – Brexit

2.European Union (EU) regulations

3.Bilateral social security agreements

- UK – Brexit

On 31 January 2020, the UK left the EU – commonly known as Brexit. The Convention on Social Security between Ireland and the United Kingdom (pdf) was agreed to ensure that:

- Irish citizens living in Ireland can still benefit from social insurance contributions made while working in the UK, and vice versa

- EU citizens living in Ireland can use their social insurance contributions made when working in the UK to help them qualify for certain Irish social welfare payments

- Existing payments continue to be paid as before.

2.European Union (EU) regulations

Social security provisions have existed in EU law for more than 30 years. Covers over 30 countries and over 12 benefit types

You can read more about how bilateral agreements are applied on the Department of Social Protection’s website.

EU regulations relating to social security generally apply to the following people:

- Nationals of the countries covered by the regulations, who are or have been insured in one of these countries, and their family members.

- People with the status of stateless people or refugees who are or have been insured in any of the countries covered by the regulations and their family members.

- Nationals of non-EU countries legally residing in the territory of the EU, who have moved between countries covered by the regulations and their family members.

3.Bilateral social security agreements

Bilateral social security agreements are specific arrangements between participating countries that allow people to move between countries and protect their pension entitlements.

Ireland has bilateral social security agreements with:

- Australia

- Austria

- Canada

- Japan

- New Zealand

- Quebec

- Republic of Korea

- UK (Covering Channel Islands and the Isle of Man

- USA

How to calculate your State Pension (Contributory) rate in 2025

From 1 January 2025, if you were born on or after 1 January 1959, your pension rate will be calculated using:

Method 1: The ‘Total Contributions Approach (TCA) OR Method 2: A combination of the ‘Yearly Average’ (YA) and the ‘Total Contributions Approach’ (TCA)

If you would receive less than the maximum State Pension (Contributory) rate using Method 1 (TCA), the Department will calculate a rate using Method 2.

You will get whichever rate is greater.

Method 1: Total Contributions Approach (TCA)

The TCA method uses your total number of contributions before you reach the age of 66 or the age you defer your pension to.

Using the TCA method, you will qualify for the maximum personal rate of State Pension (Contributory), if you have 2,080 or more PRSI contributions (for example, 40 years of employment).

The TCA calculation takes into account:

- Full-rate PRSI contributions from paid employment or self-employment

- High-rate and special voluntary contributions

- The HomeCaring Periods Scheme and Long-Term Carers Contributions for time you spent caring. You can use Long-Term Carers Contributions and the HomeCaring Periods Scheme together, as long as the periods of care do not overlap.

- Up to 10 years credited contributions. However, your combined HomeCaring Periods and credited contributions cannot total more than 1,040 (20 years).

If your combined total of paid contributions from work, voluntary contributions, Long-Term Carer’s Contributions, HomeCaring Periods and credited contributions is at least 2,080, you will get the maximum State Pension (Contributory) rate. If it is less than 2,080, you will qualify for a reduced rate of pension.

Example:

If you have a combined total of 1,040 contributions, made up of HomeCaring Periods and paid contributions, this would entitle you to 50% of the maximum pension (1040 / 2080 x 100 = 50%).

Or, if you have a combined total of 1469 contributions, this would entitle you to 70.62% of the maximum pension (1469 / 2080 x 100 = 70.62%)

TCA State Pension (Contributory) rates in 2025

The maximum State Pension (Contributory) (SPC) rate depends on your age when you draw down your SPC. If you draw down your SPC in 2025, the maximum rates are:

| Total Contributions Approach (SPC) | Maximum weekly rate (2,080 contributions and over) | Maximum increase for a qualified adult (under 66) | Maximum increase for a qualified adult (over 66) |

| Age 66 at SPC draw down | €289.30 | €192.70 | €259.40 |

| Age 67 at SPC draw down | €302.90 | €201.80 | €271.60 |

Method 2: Yearly Average (YA) and TCA method combined

In 2025, your State Pension (Contributory) (SPC) rate can be a combined rate using:

- 90% of the rate calculated using the YA method and

- 10% of the rate calculated using the TCA method (see above)

How to calculate your SPC using the Yearly Average (YA) method

The Yearly Average (YA) method calculates the average number of contributions you have made each year, from the year you first entered insurance, to the end of the tax year before you reach pension age.

You need an average of 10 contributions a year, paid or credited, to get a minimum pension, and you need an average of 48 a year to get the maximum pension.

Your yearly average is rounded to the nearest number. For example, 9.4 is rounded down to 9 and 47.5 is rounded up to 48.

If you spent time working in the home (caring)

The DSP can ‘disregard’ (not take into account) up to 20 years spent as a homemaker when calculating your yearly average. The Homemakers’ Scheme can only be used when calculating your yearly average number of contributions.

If you started work before 1979

If you started work before 1979 the DSP can assess your Yearly Average using just your record after 1979, if it would help you qualify – this is called the Alternative Yearly Average.

Calculating the Contributory State Pension Rate wef 01/10/2025 using two methods

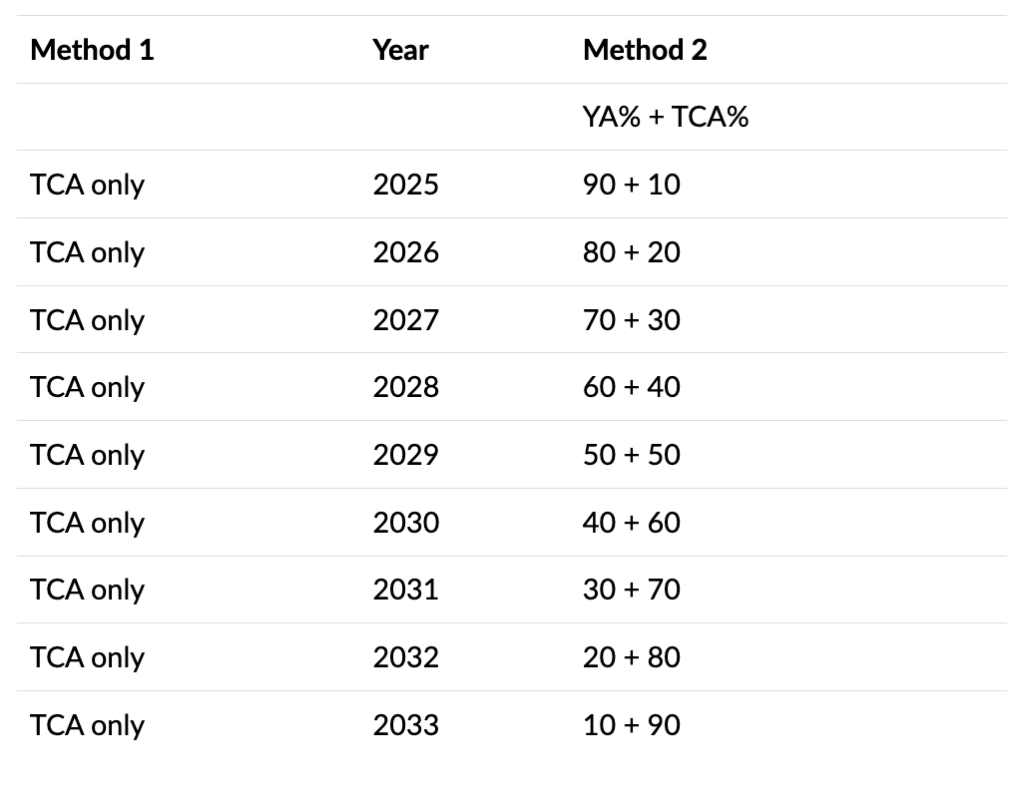

From 2025, the Yearly Average method will begin to be phased out over a 10-year period. By 2034 all rates of payment will be calculated using only the Total Contribution Approach (TCA – see above)

During the 10-year transition period, the rate of State Pension (Contributory) payable will be calculated using two methods as set out in the table opposite – Total Contribution Approach (TCA) see above and Yearly average (YA) see above

Having compared the outcome of Method 1 and Method 2, the higher rate will be awarded to you.

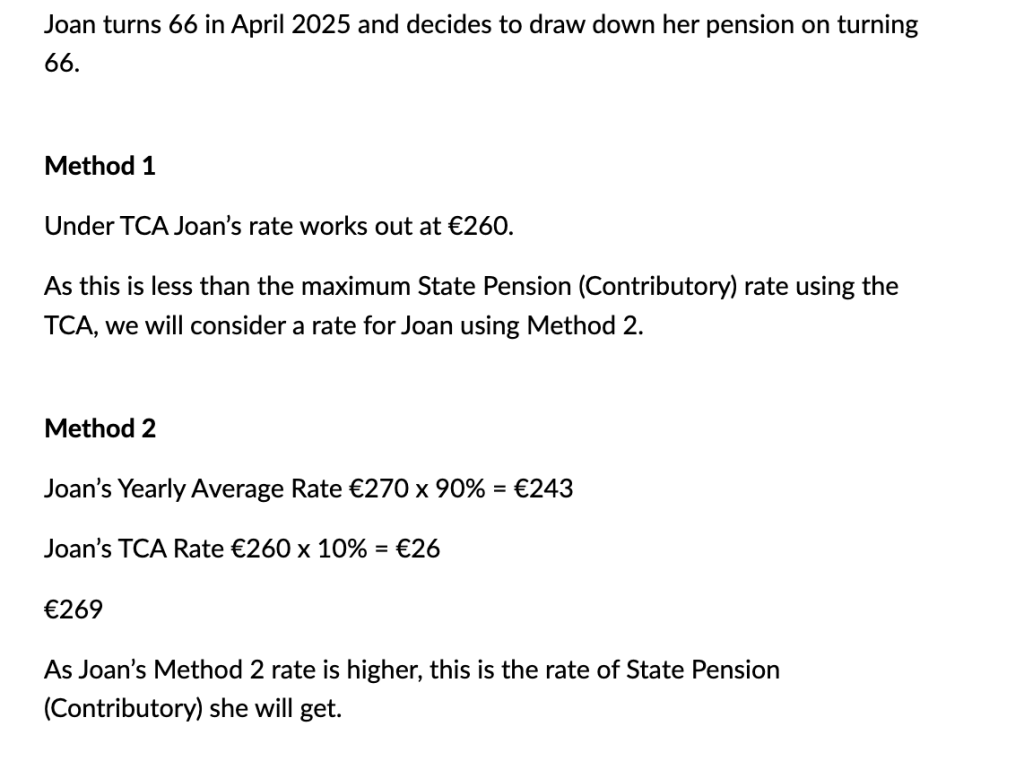

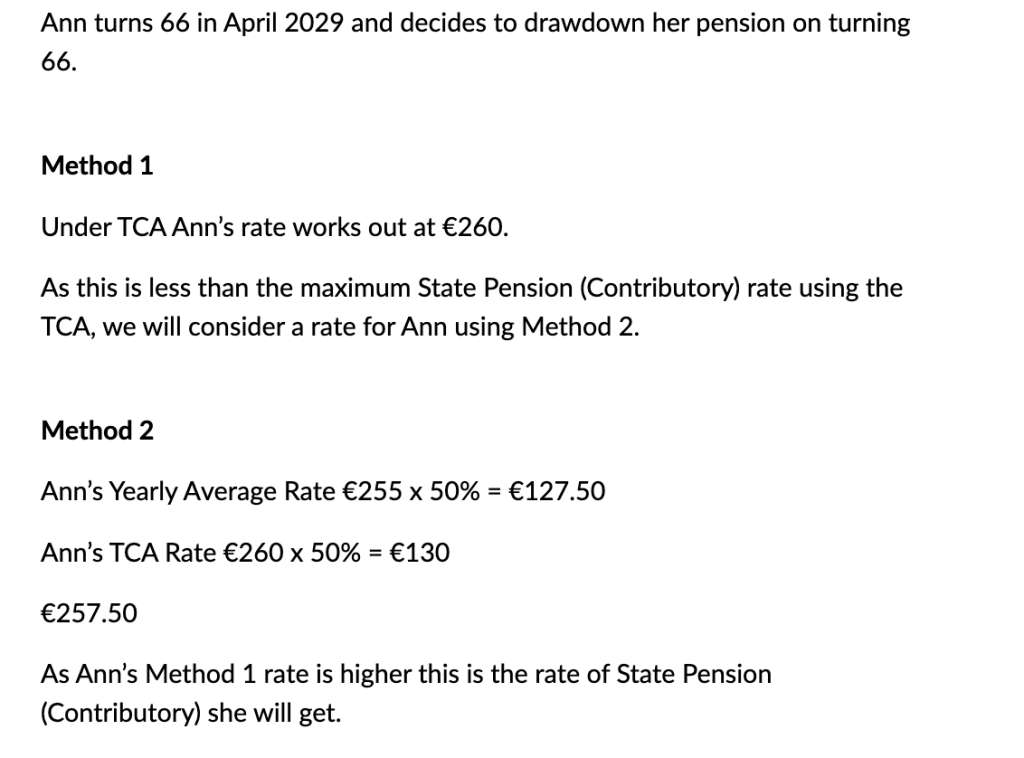

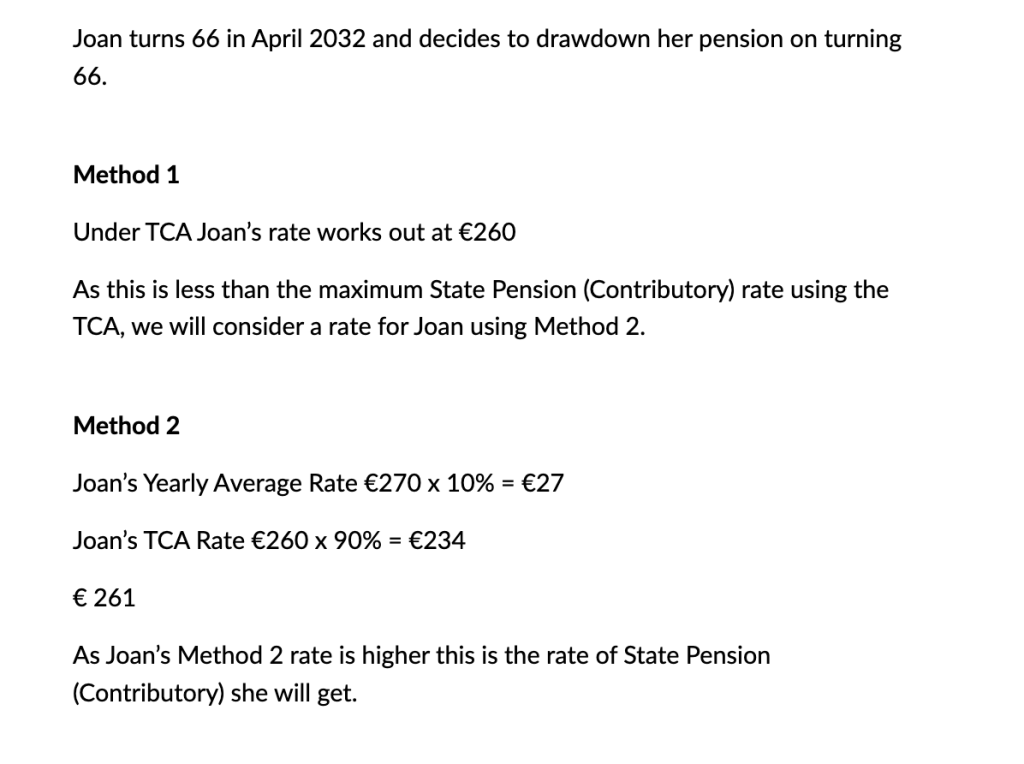

Examples of Calculating your State Pension Contributory

From 2034 there will only be one method of calculation for your State Pension (Contributory) rate. All rates of payment will be calculated using the Total Contribution Approach method only.