always seek independent legal/financial or other advise

Change is all around us

Crosswords- which way to move forward

Change

The only constant in our lives is change and it seems that the rate of change is ever increasing. Change impacts the following significant areas in our lives:

- Our Role

- Our Relationships – work and personal

- Our Routines

- Our Assumptions (past/present and future)

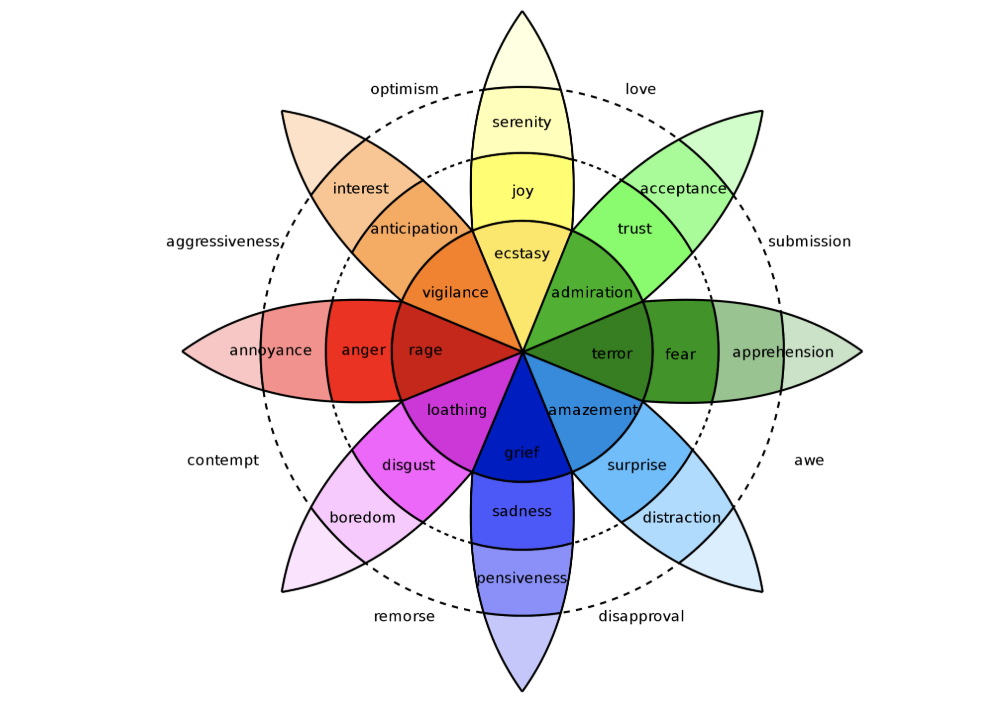

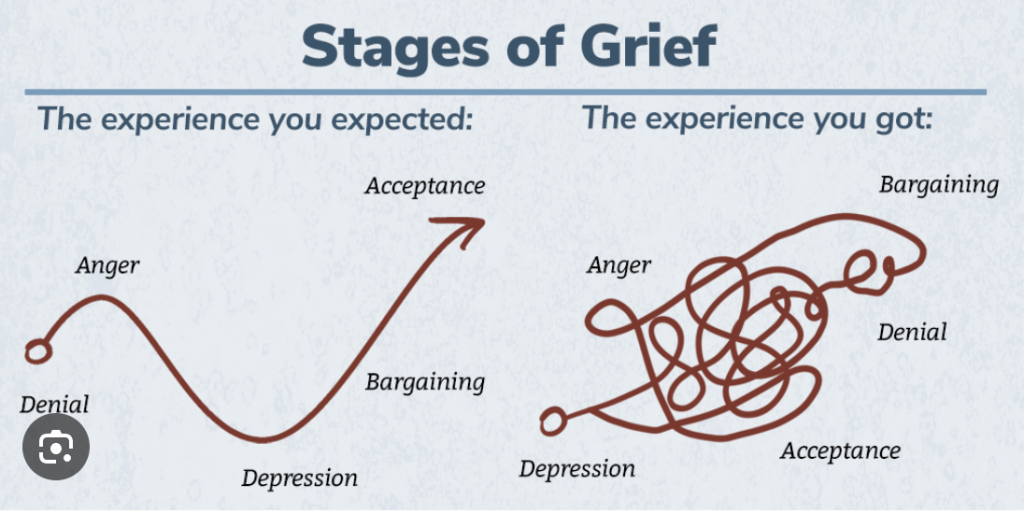

Emotions, Grief and Redundancy

Emotional wheel -https://www.davidhodder.com/emotion-and-feeling-wheel/

Grief – https://speakinggrief.org/get-better-at-grief/understanding-grief/no-step-by-step-process

Navigating Redundancy: (1 day workshop)

can be offered onsite, external and bespoke to the organisation

Looking at the following

- Understanding Redundancy and me

- The Change and Change Curve

- Emotional Well-being

- Circle of Control,lifelong learning and Growth Mindset

- Managing Stress

- Understanding and Finding my Purpose

- Budgets and Expenditure: Planning for the Future

- Resilience, Action Planning and Moving Forward

What counts as genuine redundancy?

When does Redundancy Happen?

Where you lose your job because your employer is closing the business or reducing the number of staff, this is known as redundancy. It happens when your job in the company no longer exists, you are let go and are not replaced.

Redundancy is a last option

Your employer must consult with you before deciding to make you redundant. Redundancy is a last option and there must be valid economic, technical, or organisational grounds justifying changes in the workforce.

Before your employer makes you redundant, they might offer you another job in the business. This is known as alternative work.

First Redundancies Reported

Your employer must be able to justify that there is a genuine reason for making you redundant.

Reasons for redundancy include:

A genuine redundancy is one where your employer has a real business reason to make you redundant.

- Financial difficulties within the business: for example, your employer needs to cut costs and this means staff numbers must be reduced.

- Lack of work: for example, your employer no longer needs or has a reduced need for employees with your skills or new technology has made your job unnecessary.

- Reorganisation within the business: for example, your employer has decided to carry on the business with fewer or no staff or the job you do no longer exists.

- Business closure: the business is closing down or moving.

Redundancy

Redundancy is dismissal from your job, caused by your employer needing to reduce the workforce resulting in your job no longer existing.

The burden of proof is on your employer to show that a legitimate redundancy situation exists and that therefore the dismissal is fair.

For the dismissal to be fair, your employer must also show that you were failry selected for redundancy and that fair procedures were followed.

If you do not agree that the dismissal is fair, you need to show one or more of the following:

- That there is no economic justification for the redundancy

- The reasons you have been given for redundancy are not genuine

- You have been replaced

- Fair procedures have not been followed

- You were unfairly selected for redundancy (for example because of your age or race)

Dismissal

Your employer must have reasons that justify your dismissal. You may be dismissed from your job for one of the following reasons:

- Capability

- Competence

- Qualifications

- Conduct

Being selected for redundancy

Your employer should use a fair and objective way of selecting people to make redundant.

This means that it should be based on some objective (unbiased and factual) reasons why you were selected and other employees were not selected.

Methods of Fair selection

It is up to your employer which selection criteria they use, as long as they can show that they are fair and reasonable.

The most commonly used selection methods are:

- The ‘last in, first out’ method, where the newest member of staff is the first one to go

- Asking if employees want to volunteer for redundancy, known as voluntary redundancy

- A points system, where all employees doing the same job are ranked by objective criteria (could include attendance record, standard of work, skills and qualifications).

Methods of Unfair selection

Your employer cannot select you for redundancy for personal or non-job-related reasons.

They must be able to show the objective reasons (unbiased and factual reasons) why you were selected and other employees were not selected.

Grounds that are always unfair

Under the unfair dismissals legislation, it is unfair if you are selected for redundancy based on certain specific grounds, including:

- Trade union activity

- Pregnancy

- Religious

- Political opinions

Your employer cannot make you redundant using any of the 9 grounds of discrimination, including your age, gender, race or sexual orientation.

HSE Balancing Stress – free on line programme

Everyone experiences stress at times. This programme can help you understand and manage stress.

Compulsory and Non-compulsory Redundancy

Compulsory redundancy

Compulsory redundancy is where your employer needs to reduce the workforce and decides to make redundancies. The employer identifies which employees will be made redundant but must make sure they use fair selection criteria.

Non-compulsory redundancy

Non-compulsory redundancy can be through voluntary redundancy or early retirement.

Voluntary redundancy

This is where your employer needs to reduce the workforce and asks employees if they would like to volunteer for redundancy.

There must be a fair and transparent selection process. You may not automatically be selected just because you applied.

Early retirement

This is where your employer offers incentives to retire early. You are typically allowed to start receiving some pension payments earlier than you would have in a normal retirement situation. It can be used as an alternative to voluntary redundancy.

Collective redundancies

You may be part of a collective redundancy if your employer is making a certain number of employees redundant during any period of 30 consecutive days.

It is a collective redundancy where there is:

- 5 employees made redundant out of a workforce of 21 to 49 employees

- 10 employees made redundant out of a workforce of 50 to 99 employees

- 10% of employees made redundant out of a workforce of 100 to 299 employees

- 30 employees made redundant out of a workforce of 300 employees

Rules on collective redundancies

Your employer must follow certain rules if there is a collective redundancy situation.

Requirement to consult

Your employer must enter into consultations with a view to agreement with your representative. These consultations must take place as soon as possible and at least 30 days before the notice of redundancy is given. The aim of the consultation is to consider whether there are any alternatives to the redundancies.

These rules are set out in the Protection of Employment Acts 1977-2024.

If your employer makes you redundant before the 30-day notice period ends, you have the right to seek redress from the Workplace Relations Commission (WRC).

The Employees (Provision of Information and Consultation) Act 2006 also requires employers to consult with employees on substantial changes in the workplace, including proposals for collective redundancies. The Act applies to employers of 50 people or more.

Information your employer must provide

Your employer must provide the following information in writing to your representatives:

- The reasons for the redundancy

- The number and descriptions of the employees affected

- The number and descriptions of employees normally employed

- The period in which the redundancies will happen

- The criteria for selection of employees for redundancy

- The method of calculating any redundancy payment

Your employer must also inform the Minister for Enterprise, Trade and Employment in writing of the proposed redundancies at least 30 days before the occurrence of the first redundancy. SI 324/2024 sets out the information your employer must provide to the Minister.

If your employer is insolvent

If your employer’s business becomes insolvent, a liquidator, provisional liquidator, receiver or any other person, may be appointed by the courts to manage the business.

They are called the ‘responsible person’, and they take the place of your employer in the consultations.

The rules on collective redundancies which apply to your employer, also apply to the responsible person.

Responsible persons can continue consultations started by your employer. They don’t have to restart the 30-days’ notice after their appointment.

Redundancy during sick leave, maternity leave and carer’s leave

You are made redundant on sick leave

if your employer decides to make you redundant while you are on sick leave, you may be able to bring a claim for unfair dismissal. Unless your employer can prove there was a genuine redundancy situation and that fair procedures were followed, your dismissal may be found to be unfair.

Even if a genuine redundancy situation exists, you may bring a claim for unfair dismissal if you think that you were unfairly selected for redundancy. Your employer should apply selection criteria that are reasonable and are applied in a fair way.

You are made redundant on maternity leave

You cannot be made redundant while on maternity leave or additional maternity leave. You may be made redundant when you return to work or while you are pregnant before you go on maternity leave.

If you are selected for redundancy because you are pregnant, you may be able to bring a claim for unfair dismissal. Selection for redundancy based on certain grounds such as pregnancy is considered unfair under the unfair dismissals legislation.

You are made redundant on carer’s leave

If you are dismissed on grounds of redundancy, while on carer’s leave, under the Carer’s Leave Act 2001 it would be considered unfair dismissal.

If your employer does not allow you to return to work at the end of your carer’s leave you may be able to bring a claim under the unfair dismissals legislation. However you may be made redundant after you have returned to work.

Collective Redundancy Handbook

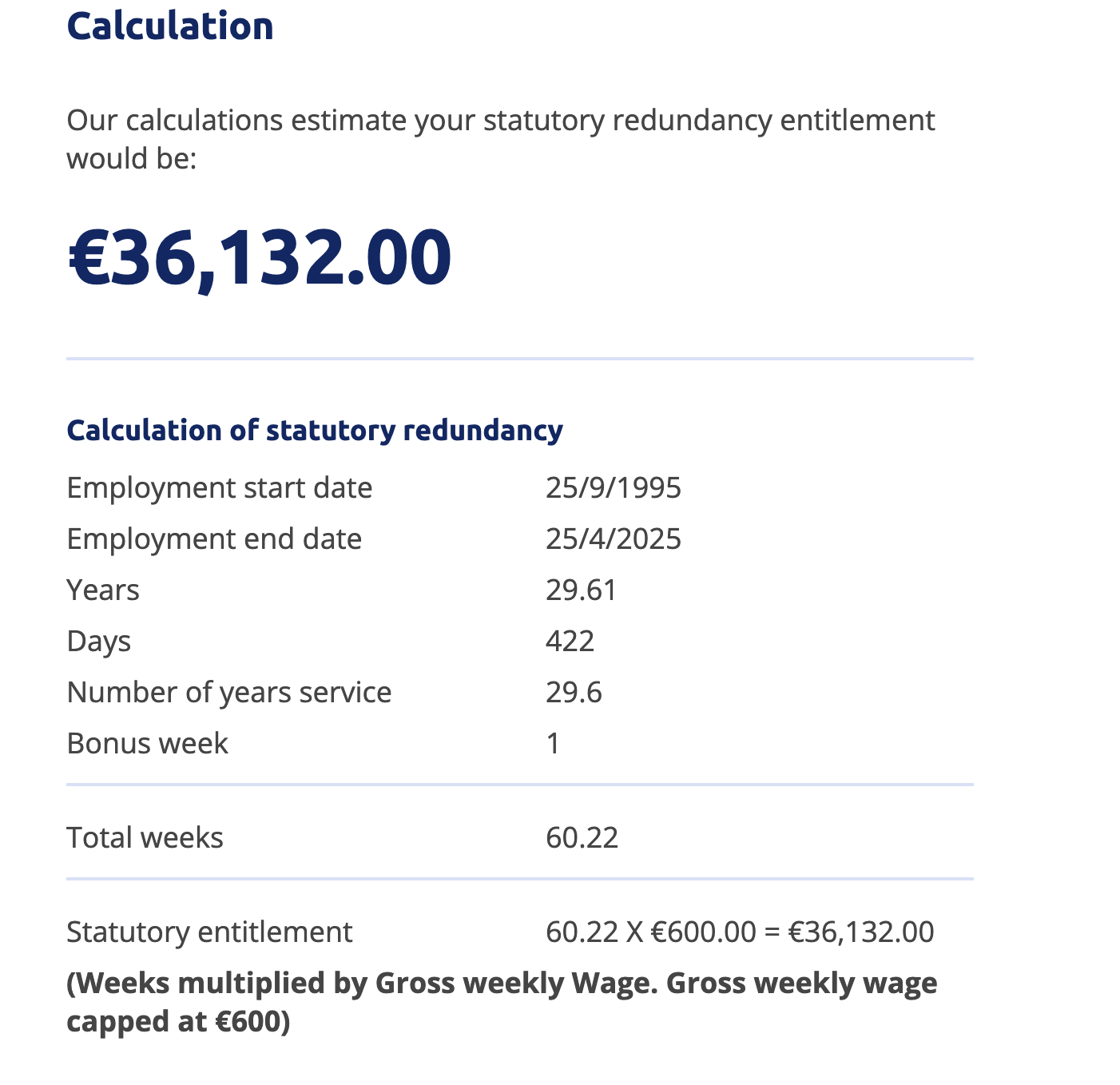

Redundancy Calculation Example

Jobseeker’s Pay-Related Benefit

What is Jobseeker’s Pay-Related Benefit?

Jobseeker’s Pay-Related Benefit (JPRB) is a payment you can get if you become unemployed.

The amount of JPRB you get is directly linked to your earnings from work before you became unemployed.

How to qualify for Jobseeker’s Pay-Related Benefit

To qualify for Jobseeker’s Pay-Related Benefit, you must:

- Become fully unemployed on or after 31 March 2025 (your last day of employment must be on or after Friday 28 March 2025)

- Be under 66 years of age, or under 70 years and deferring you State Pension (Contributory)

- Be capable of work and be available for full-time work

- Be genuinely seeking work

- Have enough paid PRSI contributions at Class A, H or P – see below

PRSI contributions

PRSI contributions from insurable employment are also called paid PRSI contributions.

You must meet all 3 PRSI contribution conditions for Jobseeker’s Pay-Related Benefit:

- At least 104 PRSI contributions from employment at Class A, H or P

- At least 4 PRSI contributions from employment at Class A or H in the 10 weeks before making your JPRB application

- At least 26 PRSI contributions from employment at Class A or H in the 52 weeks before your first day of unemployment

Rate of Jobseeker’s Pay-Related Benefit

You can get Jobseeker’s Pay-Related Benefit (JPRB) for up to 9 months (39 weeks), if you have at least 5 years of PRSI contributions from employment (also called paid PRSI contributions).

In 2025, Jobseeker’s Pay-Related Benefit weekly rate, if you have at least 260 (5 years) paid PRSI contributions:

| Weekly payment | Paid for |

| 60% of earnings up to a maximum of €450 | First 3 months (13 weeks) |

| 55% of earnings up to a maximum of €375 | Next 3 months (13 weeks) |

| 50% of earnings up to a maximum €300 payment | Last 3 months (13 weeks) |

The minimum weekly payment is €125.

You can get JPRB for up to 6 months (26 weeks), if you have between 2 and 5 years of PRSI contributions from employment.

In 2025, Jobseeker’s Pay-Related Benefit weekly rate, if you have between 104 and 259 (2-5 years) paid PRSI contributions:

| Weekly payment | Paid for |

| 50% of earnings up to a maximum for €300 | 6 months (26 weeks) |

The minimum weekly payment is €125.

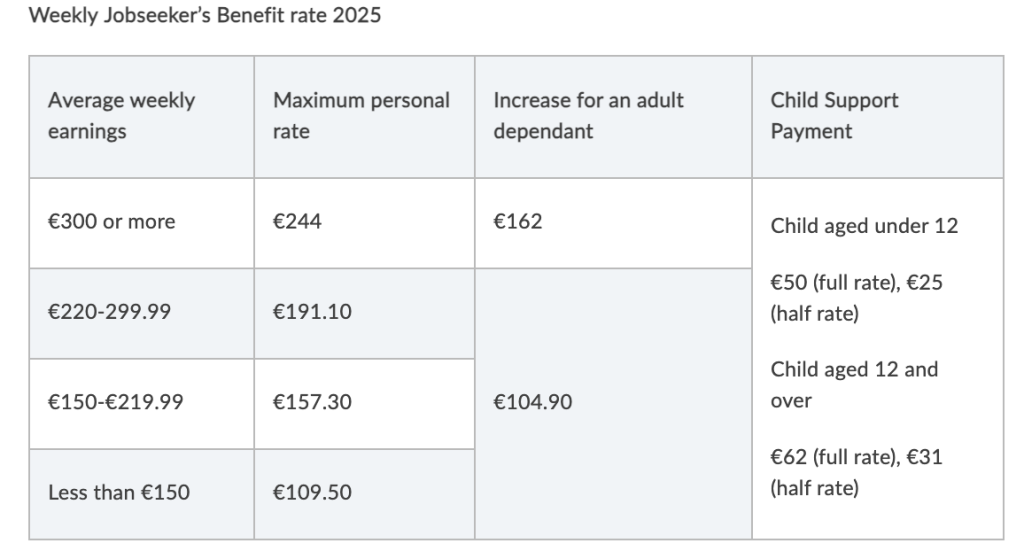

Jobseeker’s Benefit

What is Jobseeker’s Benefit?

Jobseeker’s Benefit is a weekly payment from the Department of Social Protection (DSP) to certain people who are out of work and are covered by social insurance (PRSI).

You may get Jobseeker’s Benefit, if you don’t qualify for Jobseeker’s Pay-Related Benefit because you became unemployed before 28 March 2025, or you are:

- A part-time, casual or seasonal worker

- A short-time worker

- A retained fire fighter

- Temporarily laid-off work continuously at specific times during the year, for example, your employment is based around the school or academic year.

If you don’t qualify for Jobseeker’s Benefit or Jobseeker’s Pay-Related Benefit, you may qualify for Jobseeker’s Allowance.

How to qualify for Jobseeker’s Benefit

To qualify for Jobseeker’s Benefit (JB) you must:

- Be under 66 years of age, or under 70 years and deferring your State Pension (Contributory)

- Be unemployed (you must be unemployed for at least 4 days out of 7)

- Have had a substantial loss of employment and as a result be unemployed for at least 4 days out of 7 (this does not apply to casual workers and part-time fire fighters)

- Be capable of work

- Be available for and genuinely seeking work

- Have enough social insurance (PRSI) contributions

Rate of Jobseeker’s Benefit

Your rate of payment will depend on your average weekly earnings in the governing contribution year.

How to Apply

Apply online

If you have a verified MyGovID account, you can apply online on MyWelfare.ie

If you cannot apply online

You can request a Jobseeker’s Benefit paper application form, UP 1, by e-mailing Jobseekersforms@welfare.ie. Alternatively, you can also apply for Jobseeker’s Benefit by going to you local Intro Centre or Branch Office

always seek independent legal/financial or other advise