Finances can be scary – but the following guide may assist.

I could never grasp the concept of budgeting and then I came across the process of developing a spending plan

Made sense to me just the term, a spending plan, a light bulb moment.

Take one step at a time and you can arrive at the top of the mountain. Understand your finances

4 Possible Financial Priorities

- Build an emergency fund

- Start a pension

- Save and buy your own home

- Reduce debt – including credit card dept

Income and Spend

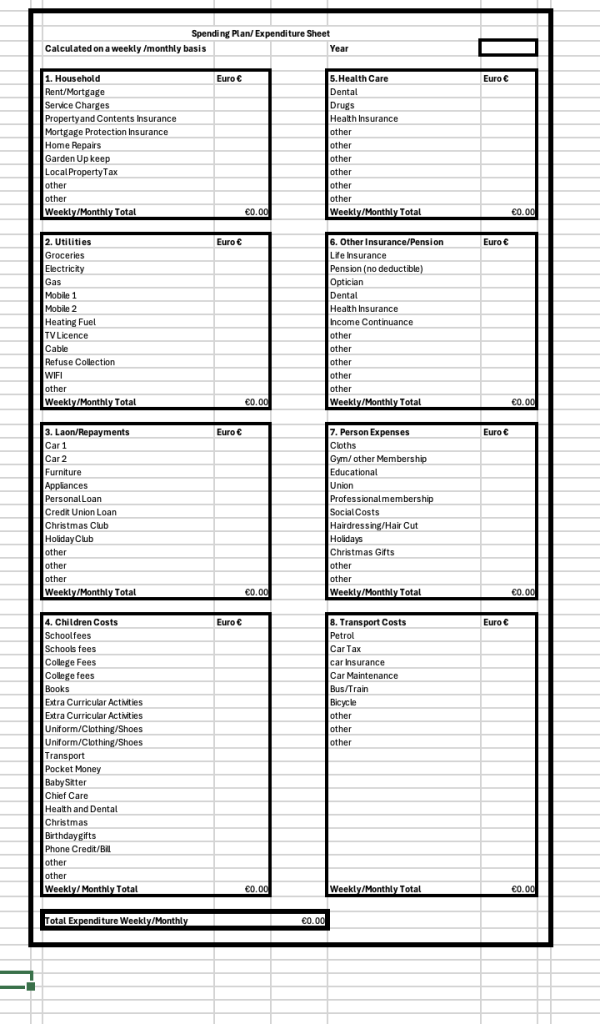

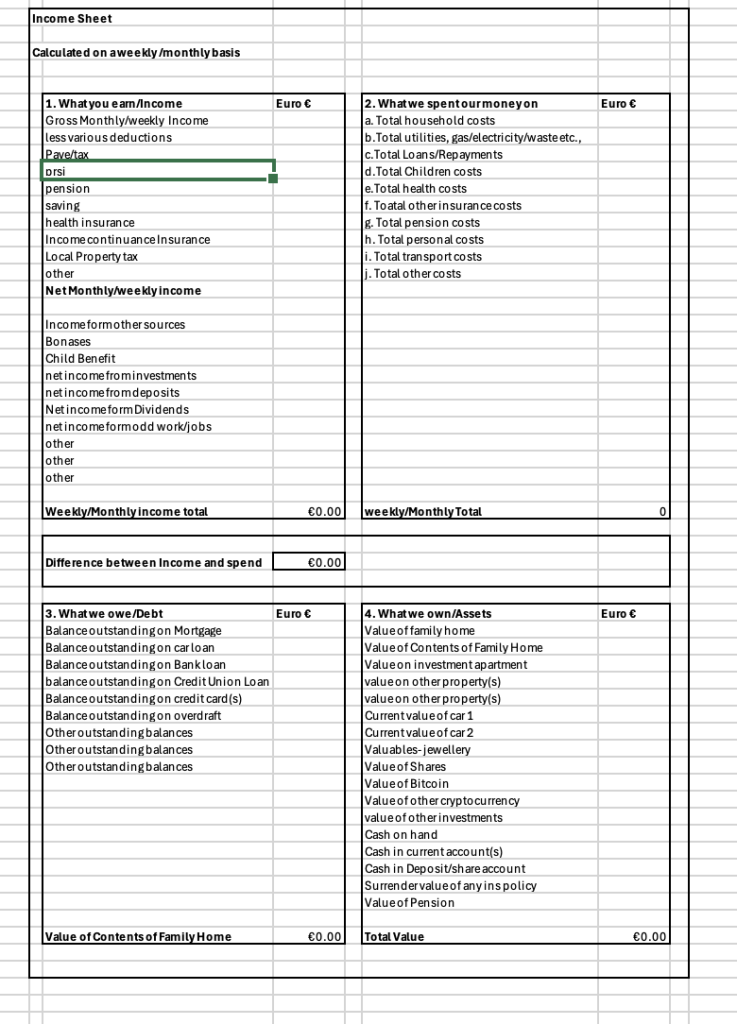

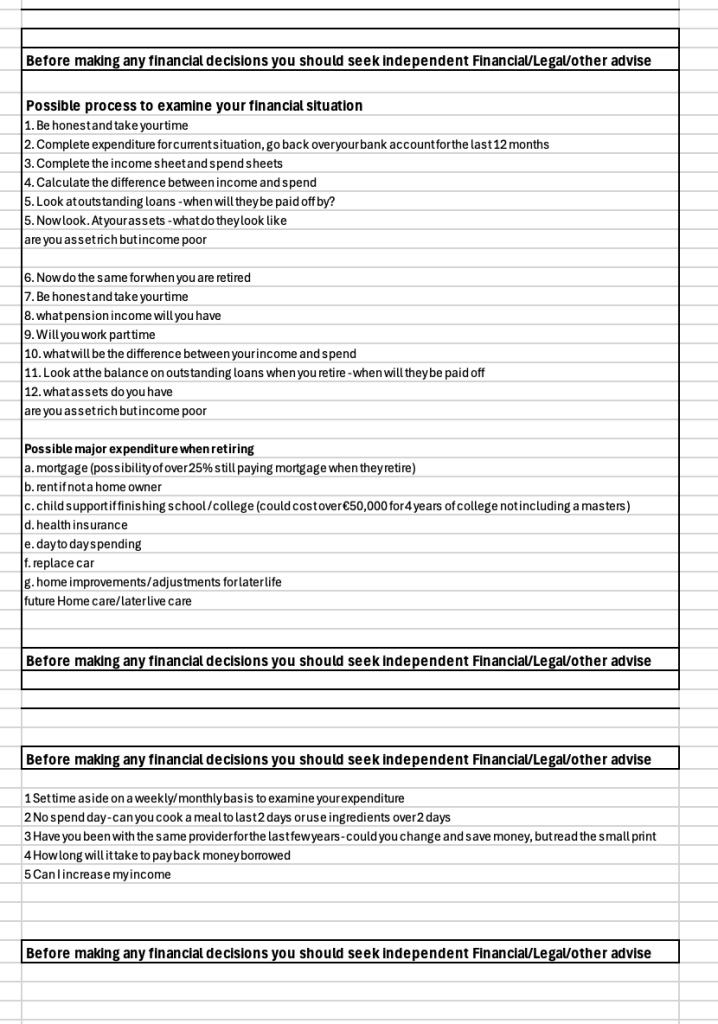

have a look at the following excel sheets to track your income and your spend. (Can print down so done need to use excel)

the excel images below , set out what are contained in the excel or pdf files

You can record you income, assets and you spend so as to track your outgoings

the following excel file may assist

the following PDF file may assist

MABS

MABS is the Irish money advice service. We have been supporting people with money advice, budgeting, and problem debt for 30 years.

Our service is free of charge.

MABS is here for you if you need help with debt and budgeting. You can get impartial advice from MABS to help you manage your money and take control of debt. They offer support online, over the phone and face to face.

Money Matters – a personal finance course for Junior Cycle

The Competition and Consumer Protection Commission (CCPC) is delighted to offer Money Matters, a personal finance course for Junior Cycle.

Teaching personal finances can be demanding in the classroom. Money Matters will help build this important life skill, making the learning experience engaging and interactive. ‘Money Matters’ will help students to make informed choices regarding their finances now and in the future.

Where to find a regulated and qualified financial adviser with relevant experience and personal finance courses